作者:胡鹏(Penny Hu)、Phuong Thao Bui

越南的软件外包服务在过去十多年中实现了显著增长。许多日本倾向于将他们的大部分 IT 工作外包至越南。英特尔、IBM、思科、KDDI、微软等美国顶尖科技公司也一直在越南进行积极且持续的投资。

诸如北电网络和安海斯布什等其他发达国家的科技企业,近年来也在越南设立了分支机构,并聘请了当地软件开发人员来推进项目。这一趋势正日益成为主流。

本文将深入探讨选择越南进行软件外包的理由,以及越南软件外包企业能够享受的优惠政策和激励措施。

为什么选择越南软件外包?

大量年轻IT专业人才

目前,越南IT行业拥有超过55万名开发人员,主要为80后、90后及00后。每年,来自 100 多家 IT 院校的约 5 万名应届毕业生加入这个充满活力的团体,他们拥有高水平的技能,能够促进各类项目的创新发展。他们追求更加平衡和健康的生活方式,渴望深入了解公司、产品及服务,积极参与业务流程,以提升个人价值,并对公司和社会做出积极贡献。

英语流利程度

英语在越南极为普及,大学毕业生普遍拥有较高的英语水平。瑞典教育机构英孚(EF)2022年发布的英语水平指数显示,越南在全球排名第60位,在亚洲排名第7位。因此,90%的越南IT专业人员能够熟练运用英语进行交流,这一点在从事外包服务的员工中尤为突出。

成本竞争力

CIO杂志指出,越南IT外包以其成本效益成为首选,相较于美国、澳大利亚及欧洲供应商,越南能够提供高达90%的潜在成本节省,且其价格比印度和中国低出30%至50%。凭借其显著的成本优势和对高质量成果的承诺,越南正成为全球企业的首选目的地,这些企业寻求的不仅是一流的IT服务,还有竞争力的价格和值得信赖的合作伙伴。

增值税优惠

0% 增值税

依据越南法律,软件产品享有零增值税率的优惠政策。

企业所得税优惠

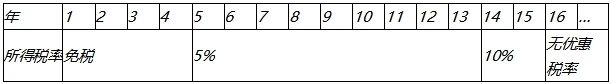

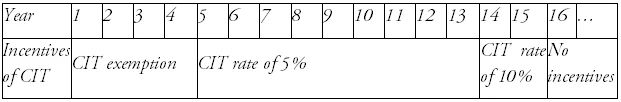

软件开发企业自获得收入之日起,可享受长达15年的企业所得税优惠,这包括免税期和减税期。若企业在前三年未产生收入,则优惠期将从第四年开始计算。

税率规定:自企业获得收入起的15年内,税率为10%,包括4年的免税期和最长9年的应纳税额减半期。

简单来说,软件开发公司自成立之日起的适用所得税率如下表:

在越南设立软件外包公司

越南允许外国投资者设立100%外资公司从事软件外包(软件开发)业务。

为了在越南设立外资公司(无论是全资外资还是合资),投资者需遵循以下步骤:

● 第一步:申请投资登记证(IRC)

● 第二步:申请企业登记证(ERC)

IRC 的有效期限最长可达 50 年。

ERC的效力不受时间限制。

公司于 ERC 颁发之日正式成立。

重要提示

享受企业所得税优惠的条件

为获取本文讨论的企业所得税激励,除了在企业登记证上注册软件开发业务外,您的越南公司还需符合以下条件:

(1) 所开发的软件必须符合第09/2013/TT-BTTTT号通知附录01中规定的软件产品标准。

(2) 至少参与一至两个软件开发的初步阶段,包括2020年7月3日第13/2020/TT-BTTTT号通知中定义的需求明确阶段和软件的分析、设计阶段。后续软件开发阶段包括:

● 编程和编码;

● 检查和实验;

● 完成和包装;

● 安装、搬运、指导、维护;

● 出版和发行。

越南公司须准备相应的证明文件,以证实其软件开发活动的每个步骤都遵循了规定的生产流程。文件的详细信息可参见第 13/2020/TT-BTTTT 号通知。

报告义务

越南公司需向信息和通信部的信息和技术局提交详细报告,说明其软件产品和开发阶段符合税收减免条件。否则可能会导致税务机关对企业所得税优惠资格质疑。

会计核算

根据越南法律规定,企业需对符合税收优惠条件的收入与不符合条件收入进行明确区分。若未单独设立账目进行核算,则将根据符合条件的收入在企业总收入中所占比例来确定优惠收入。因此,如果你的越南公司除了软件开发外还从事其他经营活动,则必须对软件开发活动进行单独核算。

越南公司的法定代表人要求

越南公司应有至少一名法定代表人,并可以有多名法定代表人。其中一名必须是越南居民。若越南公司仅有一名法定代表人,且该代表不在越南期间,必须向越南境内人员授予授权,以便在遵守当地法律的前提下,代理其职责。

简言之,若法定代表人非越南居民,则必须在越南指定一名合法授权代表。

资本规定

在申请企业登记证书过程中,必须注册并明确越南公司的资本结构,包括注册资本和可能的长期贷款资本。

注册资本是指投资者自ERC签发之日起90天内应全额缴纳至在越南持牌银行开设的资本账户的资本。

长期贷款是指期限超过1年且可选的贷款。如果投资者计划向越南公司提供长期贷款,则需要将长期贷款包含在公司注册申请中。若没有则无需注明。

Vietnam software outsourcing services have been blooming for over a decade. Many Japanese companies are choosingto outsource most of their IT work to Vietnam. Similarly, prominent US tech companies such as Intel, IBM, Cisco, KDDI, and Microsoft, etc. also have been actively and continually investing in Vietnam.

In addition, many tech companies from other developed countries such as Nortel Networks, Anheuser Bush had already set up offices and hired software developers to work on their projects in Vietnam in the past few years. The trend is becoming more and more popular.

In this article, we will explore the compelling reasons why you should consider Vietnam for software outsourcing as well as conditions and incentives available for software outsourcing companies in Vietnam.

The current workforce of Vietnam IT industry stands at more than 550,000 developers and most of them belong to Gen Z (1997 – 2012) and Millennials generation (1981 – 1996). Each year around50 thousand fresh graduates from 100+ IT institutions enter into this dynamic workforce, equipped with highly skilled abilities to drive innovation on any project. These generations desire a better balance, a healthy lifestyle, more information about the company, products, services, and want to be highly involved in the business process with an impacted contribution to their value, their company, and society.

English is the second most popular language in the country, and the majority of Vietnam’s college graduates have high proficiency in English. Vietnam is ranked at 60th globally and 7th on an Asian scale according to EF’s 2022 English Proficiency Index. Consequently, 90% of IT professionals in Vietnam proficiently communicate in English at an intermediate level or above, particularly during outsourcing projects.

CIO magazine suggests that Vietnam has emerged as a premier choice for cost-efficient IT outsourcing, presenting potential savings of up to 90% when compared to providers in the United States, Australia, other European countries and boasting prices 30%-50% lower than those in India and China. With its compelling cost advantages and dedication to high-quality processes, global enterprises are increasingly favoring Vietnam as a trusted destination for top-notch IT services at competitive rates.

According to the law of Vietnam, software products are subject to 0% VAT.

The enterprises doing software production shall receive the incentives of Corporate Income Tax (“CIT”) up to 15 years from the year the company has revenue, including the tax exemption and preferential tax rate. In case the first three years the company does not have revenue, the time shall be counted from the fourth year.

Tax rate: 10% up to 15 years from the year the company has revenue. In which, Tax exemption for 4 years, reduction of 50% of tax payable for a maximum period of 09 subsequent years.

Thus, the software producers, from the time of establishment, shall be entitled to apply the CIT rate from software production activities as follows:

Vietnam allows foreign investors to incorporate 100% foreign-owned company in software outsourcing (software production).

In order to set up a foreign-owned company (i.e. 100% foreign-owned company or joint-venture company) (“VN Co”), the investors need to conduct the following steps:

● Step 1: Apply for an Investment Registration Certificate (IRC)

● Step 2: Apply for an Enterprise Registration Certificate (ERC)

The term of an IRC can be up to 50 years.

There is no term for the ERC.

The company is legally established on the date of the ERC.

In order to be entitled to CIT incentive as highlighted in this article, in addition to registering the software production activities in the company license, the company in Vietnam must satisfy the following requirements:

(1)The software produced should be subject to software products as prescribed in Appendix 01 of Circular No. 09/2013/TT-BTTTT;

(2)The Vietnam company performs at least one or two first stages of the software manufacturing process, namely the phase of clarifying the requirements and the phase of analyzing and designing software as stipulated in Circular No. 13/2020/TT-BTTTT dated July 03, 2020. The next stages of the software manufacturing process include:

● Programming and coding;

● Examining and experimenting;

● Completing and packaging;

● Installing, transferring, instructing, and maintaining; and

● Publishing and distributing.

The VN Co should prepare the supporting documents to prove that its software-producing activities in each step are performed in line with the prescribed software production process. The details of supporting documents are also instructed in Circular No. 13/2020/TT-BTTTT.

The VN Co must submit details about its software products and manufacturing stages that comply with procedures and qualify for tax deductions to the Ministry of Information and Communications (via the Agency of Information and Technology) for consolidation. Failure to do so could lead to challenges from tax authorities regarding eligibility for corporate income tax incentives.

Under Vietnamese law, enterprises are required to segregate income from production and business activities eligible for tax incentives from those that aren't. Failure to maintain separate accounts results in determining the income from preferential activities based on the ratio of revenue from eligible activities to the total revenue of the enterprise. Consequently, if a VN Co engages in multiple activities, including software production alongside others, it must maintain separate accounting for software production.

The VN Co shall have at least one and may have more Legal Representative(s). One of them must be a resident of Vietnam.

In case the VN Co has only one legal representative, during the time the only Legal Representative does not stay in Vietnam, they are required to grant an Authorization Letter to a person in Vietnam to take over their duties under their instruction and strictly comply with the law.

In short: if the only legal representative is not a Vietnam resident, a legally authorized representative in Vietnam is required.

The Capital Structure of the VN Co which needs to be registered in the application and eventually mentioned in the IRC, includes the Charter Capital and the Long-term Loan Capital.

Charter Capital is the capital that the Investors shall pay fully to the Capital Account opened at a licensed bank in Vietnam within 90 days as of the date of issuance of the ERC.

The Long-term Loan are those having a duration of more than 1 year and optional. If the Investors have plans to grant a Long-term Loan to the VN Co, it is required to include the Long Term Loan in the company incorporation application. Otherwise, no Long-term Loan is included.

以上信息均仅供参考,并不旨在对所讨论的要点进行全面分析。本文也不旨在构成或被视为法律、税务或财务建议。如果您有兴趣在越南投资或有任何其他疑问,请联系我们。

All information provided is of a general nature and is not intended to be a full analysis of the points discussed. This article is also not intended to constitute, and should not be taken as, legal, tax or financial advice by us. If you are interested in investing in Vietnam or have any further questions, please reach out to us.